These dwellings combine the qualities of large and small surface areas.

In this case, safety will compensate for this lower yield in large houses and apartments. In other words, it is these maintenance costs that often weigh on performance. As a result, the house will be well maintained, which allows the owner to reduce the costs of maintenance and renovation. These occupants often tend to take ownership of the house. However, the advantage of investing in large surface areas is that the tenants are more stable, as they are often families. Sold or rented per square metre, these large surface area properties are less profitable. On the other hand, the only disadvantage of investing in these dwellings is that the occupants can often change. For this reason, these apartments offer a good return. The rental demand for small apartments is very high. In these cities, the target tenants are particularly students and young working people. It is important to know that these studios and T1s are highly sought after in the main student cities in France such as Toulouse, Lyon, Paris or Bordeaux. The price per square metre of a small area is much higher. However, it should be noted that, apart from the choice of location, the performance of the investment will depend on the characteristics of the property to be rented.Ĭompared to larger homes, these smaller apartments and studios pay more per square metre. Thus, compared to other types of investment, real estate ensures high profitability and positive cash flow. In some cases, it can go beyond this rate and reach 10%.

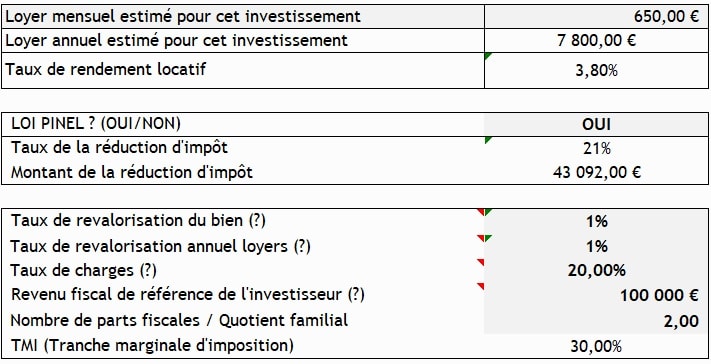

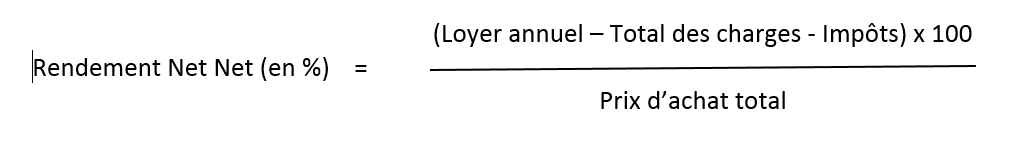

In general, the profitability of a rental investment varies from 2 to 8%. How much does an investment in rental property yield? However, in order to benefit from a good return on a rental property investment, there are many criteria to be taken into account, including the choice of the location of the property, the type of rental, the choice of taxation or the model of property to be acquired. It is possible to determine this element by taking into account the applied rent and the purchase price of the property. Profitability is the main criterion for measuring the performance of a rental investment. Buying a property to rent it allows you to benefit from an appreciable profitability. It can also be acquired with the aim of generating more income. Buying real estate is not just about acquiring a home to live in.

0 kommentar(er)

0 kommentar(er)